Estimating Project Cash Flows Is Generally the Most Important

The second major type is corporate risk which is the risk of. Estimating project cash flows is generally the most important but also the most.

Advantages And Disadvantages Of Npv Learn Accounting Accounting Classes Financial Management

Project cash flow includes revenue and costs for such a project.

. Typically a project will have a higher NPV if the. In either of these two we are concerned with the additional cash flows that will be provided. Recall that there are two basic types of projects Expansion and Replacement.

Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows - ScieMce. It is a crucial part of financial planning concerning a companys current or potential projects that dont require a vendor or. Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows.

The first is stand alone risk which is the possibility of incorrectly estimating the cash flows of a new project or business line if that new activity were the only or stand alone activity of the company. Project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process.

Methodology such as the use of NPV versus IRR is important but less so than obtaining a. Estimating cash flows the investment outlays and the cash inflows after the project is commissioned is the most important but also the most difficult step in capital budgetingEstimating cash flows process involves many people and numerous variables. Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows.

Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows. Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows True False 2. The cost of capital used to discount cash flows in a capital budgeting analysis should be calculated on a before-tax basis.

For the expansion project this is. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process.

Estimating project cash flow is generally the most important but also the most difficult step in the Capital budgeting process. There are three major types of risk involved in cash flow estimation. Choice of methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows.

This section now examines this estimation analysis. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process. Below are some basic principles of project cash flow.

Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process. Capital budgeting decisions should be based on before-tax cash flows.

Question 1 1 out of 1 points Estimating project cash flows is generally the most important and also the most difficult step in the capital budgeting process. Methodology such as the use of NPV versus IRR is important but less so than obtaining a reasonably accurate estimate of projects cash flows. Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting process.

Estimating project cash flows is generally the most important but also the most difficult step in the capital budgeting BA 520 Quiz Chapter 11-12 - 1. Estimating the cash flows is the most important part of the capital budgeting process.

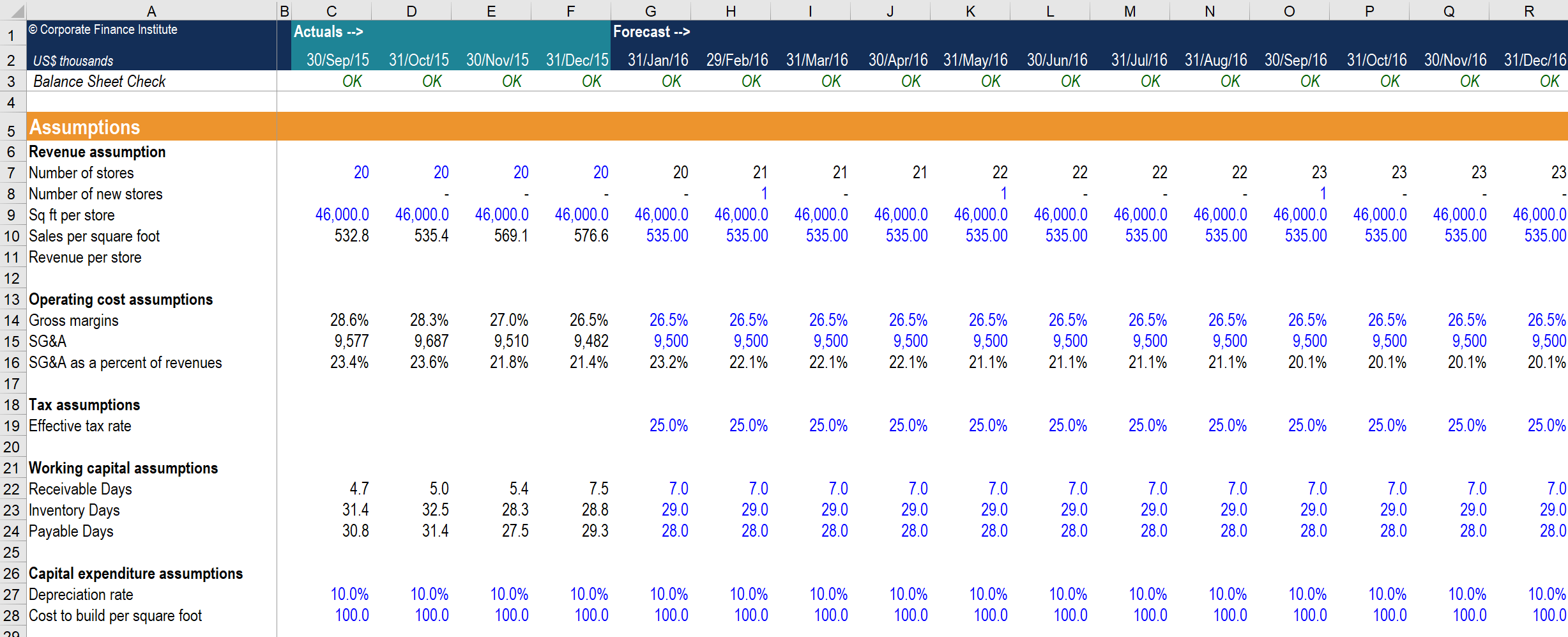

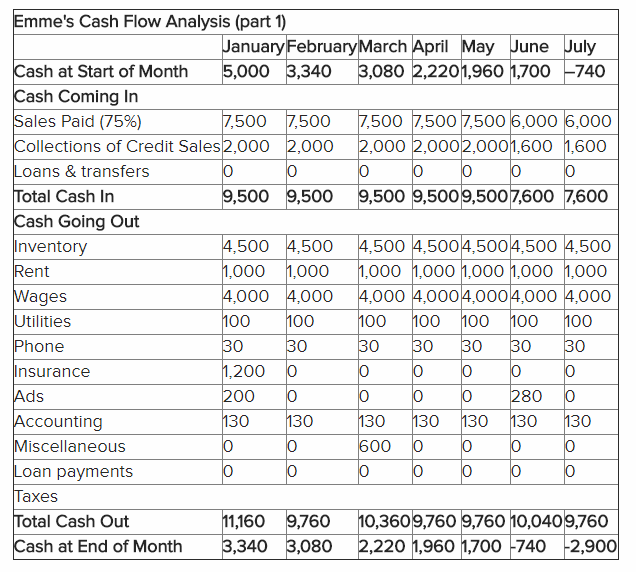

Monthly Cash Flow Forecast Model Guide And Examples

Cash Flow Table Definition Excel Example Template Analyst Answers

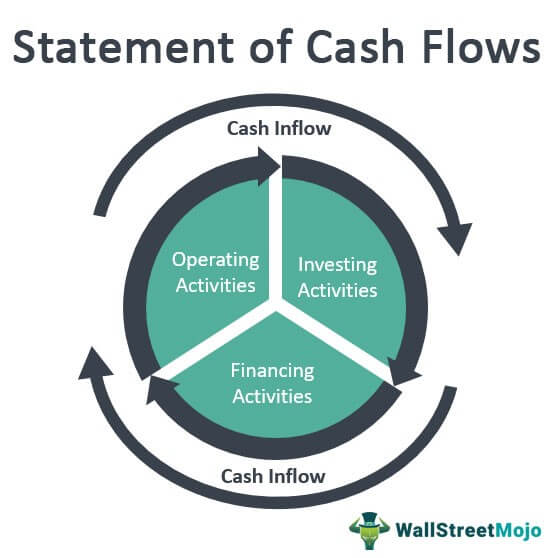

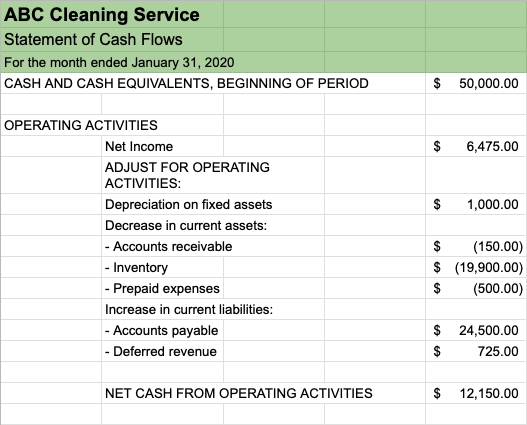

Statement Of Cash Flows Definition Format Examples

Incremental Cash Flow Definition Formula Calculation Examples

Cash Flow Statement How A Statement Of Cash Flows Works

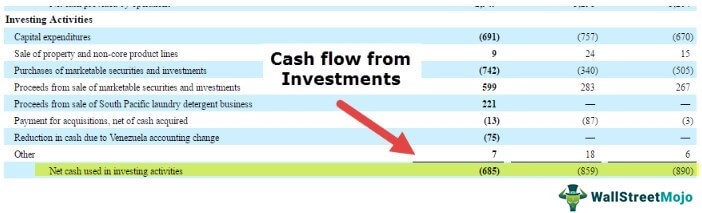

Cash Flow From Investing Activities Formula Calculations

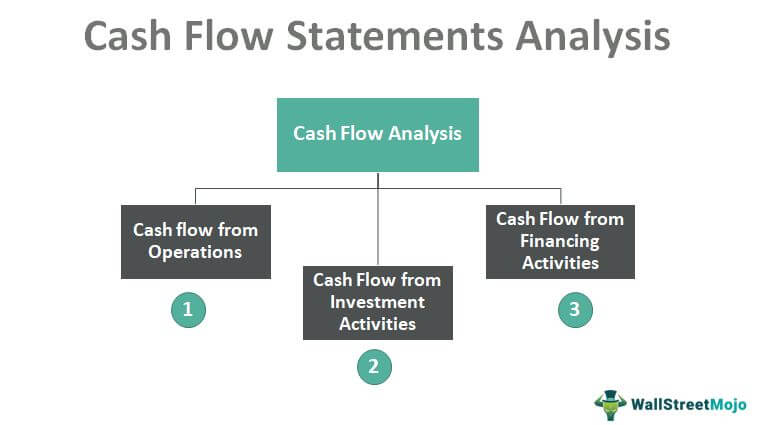

Cash Flow Analysis Examples Step By Step Guide

How To Create A Cash Flow Projection And Why You Should Wave Blog

How To Do A Cash Flow Analysis With Examples Lendingtree

Direct Approach To The Statement Of Cash Flows Principlesofaccounting Com

Cash Flow Statement How A Statement Of Cash Flows Works

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Comments

Post a Comment